Charge-back FAQ

- Details

- Kategorie: Bilder 2013

- Veröffentlicht: Donnerstag, 30. Januar 2020 11:01

- Geschrieben von Joachim L.

- Zugriffe: 844

Please be sufferer. It often takes 30 days for us to question a chargeback, and it could take your purchaser's credit card company about 75 times to come back into a final enthusiasm and deal with a chargeback.

This maintain will stay in position while you go with the buyer to fix the claim and might be launched again for you if the declare is completed in your favor. With regards to Item Not Received (INR) claims, at the time you present the kind of info mainly because outlined inside the Seller Safeguard Policy, plus the claim is decided in your favor, the amount of money might be released to you. Once a declare has been submitted, the best thing for you to do is quickly present any kind of requested data.

Proving the cardholder was aware of and approved the transaction being disputed is crucial. Any info that reveals proof of this, just like AVS (handle verification system) matches, CVV confirmations, signed receipts or perhaps contracts, or perhaps an beginning IP complementing the customer’s location can be a must. Many banks gained’t even consider the rest of your response with out this facts. It’s no secret that in the world of chargebacks, card networks nearly all enough time aspect with cardholders.

How does PayPal cope with chargebacks?

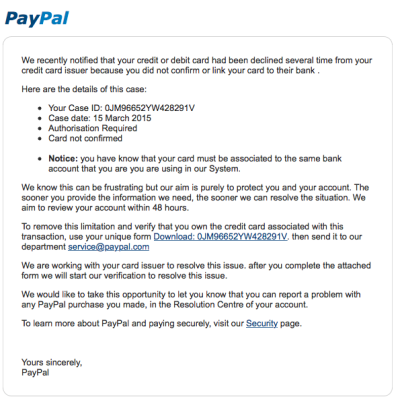

DEAL WITH SHADY ACTIVITY At PayPal we realize you, so any email from all of us will house you because of your first and last name or perhaps your business identity in the body belonging to the email. An email from PayPal will not likely ask you to give sensitive information like your pass word, bank account, or mastercard details.

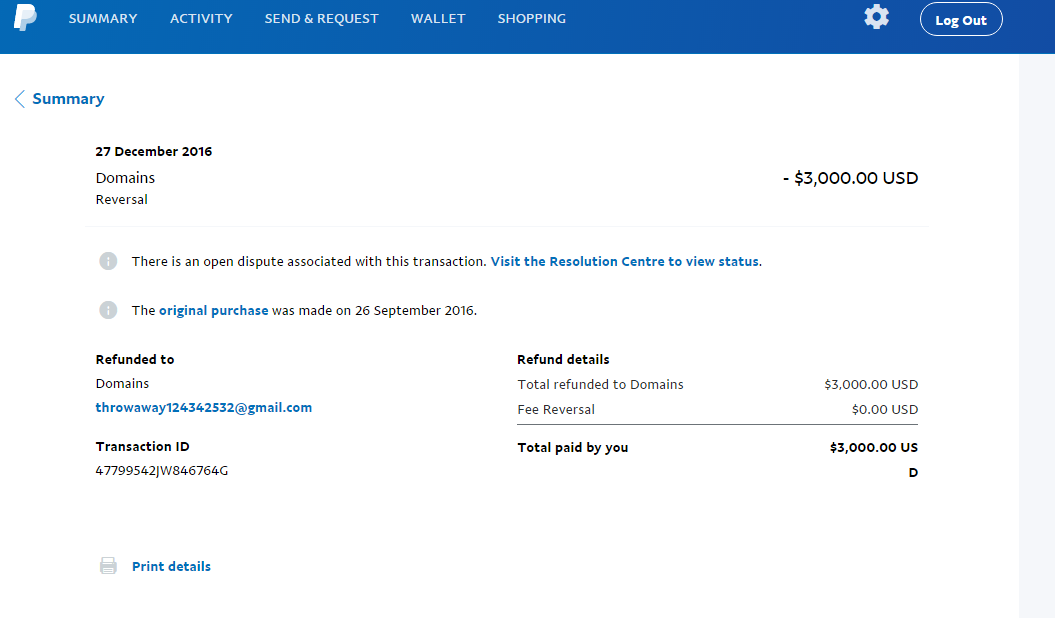

Scammers Be Scamming – My Experience With A PayPal Chargeback

It’s within a vendor’s finest curiosity to work alongside the customer to solve the argue. This is a seller’s probability to make use of great customer support to fix a problem and help forestall that from growing into one point larger. Naturally, not obtaining chargebacks by any means is the excellent … nevertheless so long as the system exists, it’s possible that cardholders will contest transactions, notably in response to unlawful fraud. The moment that happens, the best a merchant can hope for should be to study with regards to the chargeback ahead of it’s truly filed.

The mover examine accept funds and if I just write a verify or pay off by CC, so might too, the customer! The item weighs less than twenty lbs.

We certainly have a studio company. We had a buyer file a lay claim in opposition to us via his CC enterprise then they notified pay pal which fork out pal notified us of an claim. Psy pal hasnt charged us again, they're investigating the declare and now have given our proof. He had granted us a 50%deposit which is necessary to start out the roles and get the process began.

- Then we will place a brief maintain about all cash in the purchase.

- In some cases, the service provider would possibly even be combined with the Ended Merchant File, leading to a blacklisting simply by acquirers, probably destroying the full enterprise.

- Nevertheless , if a vendor goes out of business or stops control funds through PayPal, we all will use any reserve to satisfy future repayment reversals.

- This wiped out the adverse stability instantly.

- Several payment cpus will cost a merchant to get chargebacks to cowl management costs.

- Lynch says it’s a good advice to gain from these notifications so you are allowed to address charge-backs promptly.

What is a chargeback in accounts receivable?

PayPal Seller Cover covers you in the event of claims, chargebacks, or reversals that are a consequence of unauthorized purchases or things your client didn't get. With PayPal Seller Safeguard, you happen to be covered to get the full amount of all suitable transactions.

Our reseller standard bank informs us of the chargeback, and we instantly e mail the vendor. The seller will then log in with their PayPal profile and proceed to the Resolution Center to observe the ranking of the case and give information to help fix the matter.

The chargeback system exists mainly for consumer safety. Holders of bank cards issued in the us are afforded reversal rights by Control Z of the Truth in Lending Respond. United States charge card cases are given the assurance reversal rights by Rules E of this Electronic Provide for Transfer Operate. Similar legal rights lengthen internationally, pursuant towards the rules structured on the corresponding greeting card association or financial institution network. Chargebacks also occur within the distribution operate.

What Happens When Chargebacks are Granted?

For event, PayPal might compile inner data and mix that with facts you present to dispute a chargeback, every credit/debit cards guidelines. Simply having a charge-back filed against you'll not mechanically have an effect on the vendor suggestions.

You can view the chargeback payment and process in ourUser Contract. Had PayPal’s service provider loan company not ripped the cash for that chargeback, PayPal would not have got wanted to drag the vendor's funds. Be aware that if the contest is found in gain of the seller, PayPal is going to credit score the Seller’s consideration with the debated funds. Some other chargebacks happen to be associated to technical complications between the service provider and the providing financial institution, just like when a client was priced twice for a single transaction.

Paypal is really the worst in terms of vendor how to prevent paypal chargeback rights. If a new buyer submits their ask for a repayment properly, I don't think about there is virtually any means for it to fail.

This program of often takes about 30 days, however extra advanced circumstances may take longer than 30 days. Once a contest is usually opened, you might have 20 times to work with the consumer to resolve that. (PayPal gained’t be involved with this level. ) If nor you neither the customer escalates the argument in the course of the 20-day window, it is going to be enclosed automatically.